In recent years, the finance industry has undergone a massive shift. Among the most impactful changes is the rise of AI in financial consulting. As financial advisors seek faster, smarter, and more reliable ways to support clients, artificial intelligence is becoming a central tool in delivering accurate insights, forecasting, and personalized strategies.

The question isn’t whether AI will play a role in consulting—it already is. The real question is how it will reshape the entire future of financial consulting.

What Is AI in Financial Consulting?

AI in financial consulting refers to the use of artificial intelligence tools and algorithms to enhance and automate services traditionally offered by financial advisors. These include tasks like portfolio management, financial planning, risk assessment, tax optimization, and market trend analysis.

Rather than replacing human advisors, AI works alongside them. It provides deeper data analysis, helps reduce errors, and speeds up decision-making. Financial consultants can now rely on AI-powered systems to process vast amounts of information in real time, offering better advice to clients.

Start planning today—secure your future and enjoy life’s biggest milestones stress-free with smart financial strategies tailored to your goals.

Start planning today—secure your future and enjoy life’s biggest milestones stress-free with smart financial strategies tailored to your goals.

Start planning today—secure your future and enjoy life’s biggest milestones stress-free with smart financial investment planning tailored to your goals.

The Role of Digital Transformation in Consulting

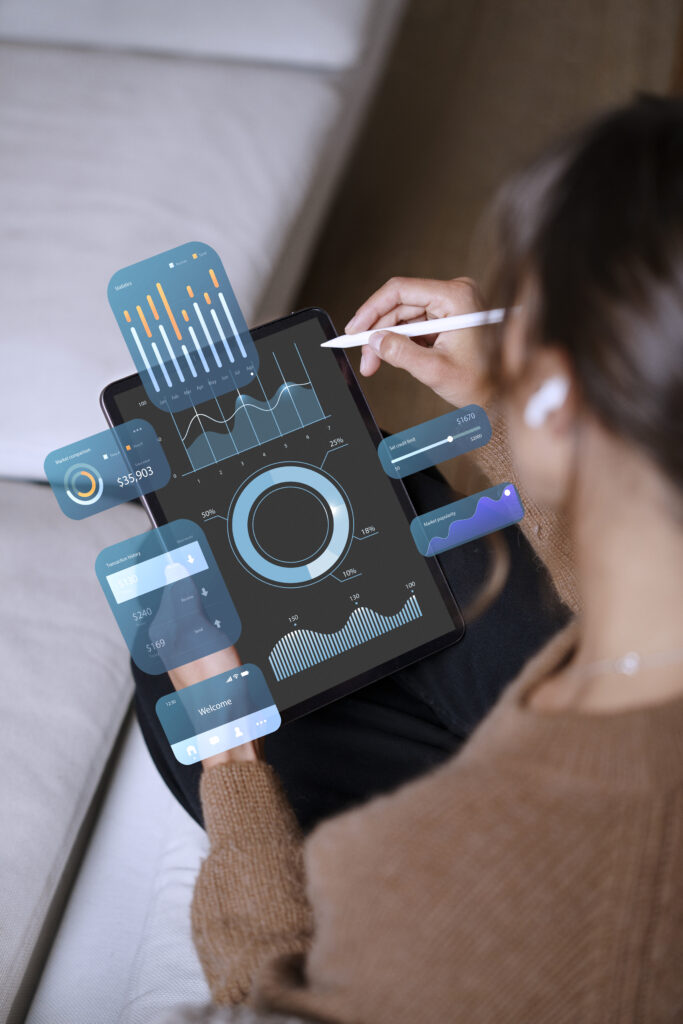

Digital transformation in consulting is about shifting from manual, paper-based, or outdated systems to advanced digital processes. This transformation is not limited to automation—it includes cloud technology, advanced analytics, machine learning, and client portals.

In financial consulting, this transformation improves transparency and efficiency. Clients can access dashboards that display real-time investment performance. Advisors can quickly create customized financial models based on live data. AI plays a big role here by driving smarter automation, improving client interactions, and offering deeper personalization.

Consulting firms that embrace digital transformation are better prepared to adapt to changing market needs. This also helps in cutting down operational costs and improving scalability.

Key Benefits of Artificial Intelligence in Finance

Artificial intelligence in finance offers several advantages for both consultants and their clients. First, it allows predictive analytics, which helps advisors forecast financial outcomes with greater accuracy. For example, AI can analyze past market behaviors to suggest future investment strategies.

Secondly, AI enhances risk assessment. Tools powered by machine learning can detect unusual patterns, helping financial professionals identify potential fraud or market volatility early. AI also improves compliance by automatically checking regulations and flagging inconsistencies.

Another major benefit is personalization. AI can assess a client’s financial behavior and recommend tailored strategies that align with their goals. From retirement plans to tax-saving investments, clients receive data-backed recommendations.

Partner with a trusted financial advice firm today and take the first step toward a secure, stress-free future. Plan smart, live confidently!

Partner with a trusted financial advice firms firm today and take the first step toward a secure, stress-free future. Plan smart, live confidently!

How AI Enhances Client Relationships

AI tools can manage routine tasks like generating financial reports, scheduling meetings, or sending reminders for important milestones. This gives consultants more time to focus on human interaction—listening, advising, and building trust.

Chatbots, for example, offer 24/7 support by answering basic client queries. Meanwhile, natural language processing tools help advisors interpret client concerns through emails or chats, allowing them to respond more thoughtfully. This combination of technology and empathy strengthens relationships.

When clients see that their financial advisor is using advanced tools to serve them better, it builds credibility and confidence. This is one of the key elements shaping the future of financial consulting.

Challenges and Considerations

While AI offers numerous advantages, there are challenges too. One major concern is data privacy. Since AI tools rely heavily on personal financial data, firms must ensure robust cybersecurity measures to protect this sensitive information.

Another challenge is over-reliance on automation. Not all financial decisions should be driven by data alone. Emotional intelligence, ethical judgment, and personal experience remain vital in financial consulting.

Moreover, adopting AI requires investment in technology and training. Consultants need to be educated on how to use AI tools effectively. This transition can be complex, especially for smaller firms.

What the Future of Financial Consulting Looks Like

The future of financial consulting is a blend of human insight and technological innovation. AI will continue to take over repetitive tasks, allowing advisors to focus on strategy and personal relationships. Clients will expect faster responses, smarter tools, and more transparency. The most successful consultants will be those who adapt quickly to technological changes while maintaining strong communication skills. As AI in financial consulting evolves, we’ll likely see more hybrid advisory models where AI tools and human expertise work hand in hand.

FAQs

No.

AI is not replacing consultants but enhancing their capabilities. It handles repetitive tasks, data analysis, and report generation, allowing human advisors to focus on relationship building, strategic thinking, and personalized financial guidance.

AI supports financial decision-making by analyzing large data sets, detecting patterns, and predicting outcomes. It helps advisors create accurate forecasts, assess risks, and offer tailored recommendations, leading to more informed and timely decisions.

Examples include robo-advisors that manage investment portfolios, AI-powered chatbots for client support, fraud detection systems, and tools that monitor market trends in real time. These applications help consultants provide smarter and faster services

Yes, with proper security.

Financial firms must implement strong data protection policies, encryption, and cybersecurity measures. With these in place, AI tools can safely manage sensitive financial data while maintaining client privacy.

Financial consultants will need to blend traditional financial knowledge with digital skills. Understanding how AI tools work, interpreting data insights, and communicating them effectively to clients will be key. Adaptability and emotional intelligence will also be important.