Estate planning isn’t just for the wealthy; it’s for anyone who wants to make sure their hard-earned assets go to the right people without causing family arguments. Planning your estate means setting up a clear plan for who gets what, which can make things a lot easier on your loved ones and help prevent family disagreements. In this blog, we’ll look at why estate planning is so important and how it can keep families united.

What Is Estate Planning?

Estate planning is about organizing what happens to your property, savings, investments, and belongings after you pass away.

Why Estate Planning Matters

It ensures your wishes are followed, provides financial security for loved ones, and reduces any extra costs and legal steps your family might face.

What’s Included

An estate plan usually has a will, trusts, a power of attorney, and medical directives. Each part has a specific role in making sure your wishes are honored.

Why Estate Planning Is So Important

Estate planning is essential if you want to provide a clear path for your loved ones. It protects your family from financial stress, delays, and disagreements.

Financial Security for Loved Ones

When you specify who gets what, your family won’t have to wait in probate, which can be costly and time-consuming.

Reducing Taxes and Fees

Estate planning helps lower the amount of taxes and fees on your assets, so more of your wealth goes directly to your loved ones.

Minimizing Legal Issues

With a clear plan in place, your family can avoid court battles and legal complications that often arise when someone passes without a will or estate plan.

How Estate Planning Prevents Family Disputes

Sometimes family dynamics become strained after a loved one passes away, especially if there’s confusion about asset distribution. Estate planning helps prevent these issues:

Avoids Confusion and Misunderstandings

Clear instructions in an estate plan leave no room for guesswork about what you wanted, which helps prevent arguments.

Fair Distribution of Assets

You can decide how to fairly distribute your assets based on your wishes and family’s needs, which can reduce feelings of unfairness or resentment.

Lowers Financial Stress

By planning, you relieve your family of unexpected financial responsibilities, like covering legal fees or taxes, which can otherwise cause stress.

Key Elements in an Estate Plan That Reduce Family Tensions

To create a solid estate plan, you’ll want to consider these components:

Will

A will clearly states who inherits your assets, who cares for minor children, and who will handle the estate. This reduces conflicts by making your wishes clear.

Trusts

Trusts allow you to set conditions on how and when your assets are distributed, keeping them safe and potentially lowering taxes.

Power of Attorney and Medical Directives

Assigning a trusted person to make financial and health decisions on your behalf ensures someone you trust is handling important matters, easing family worries.

Regular Updates

Life changes—marriages, births, and more—so update your plan regularly to reflect any new wishes or relationships.

The Emotional Impact of Estate Planning on Families

Creating an estate plan can bring peace of mind to both you and your loved ones. It allows your family to focus on grieving and celebrating your life, instead of being stuck in financial or legal stress.

Peace of Mind for Family

Knowing your wishes will be respected gives your family a sense of closure, avoiding conflicts that often arise in unclear situations.

Reduces Heir Tensions

With clear instructions in place, families are less likely to argue or feel slighted, helping them stay close during a difficult time.

Simple Steps to Start Estate Planning

Estate planning may feel overwhelming, but breaking it down into steps makes it more manageable:

List Your Assets: Make a list of what you own—property, savings, and other valuables.

Choose Beneficiaries: Decide who should inherit your assets based on your wishes and family’s needs.

Select an Executor: Pick someone responsible to carry out your wishes as outlined in your will.

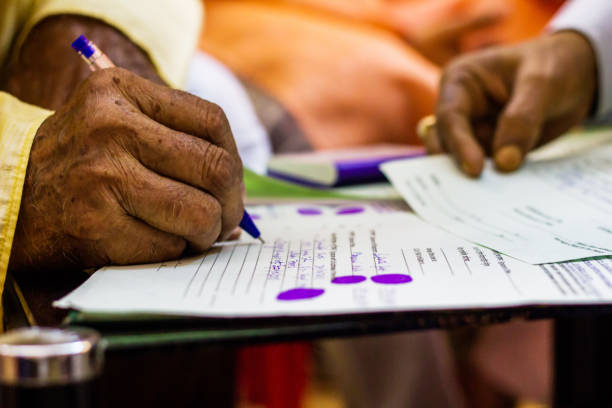

Set Up Necessary Documents: Work with a professional to ensure your will, trusts, and other documents are valid and legally sound.

Review Regularly: Life changes, so revisit your estate plan after major life events to make sure it still aligns with your wishes.

Summary

Estate planning isn’t just a financial step; it’s a way to protect your family and reduce stress and conflict. By planning your estate, you can make sure your loved ones don’t have to face unexpected legal fees, taxes, or family disputes. It’s a gift of peace and security for the people you care about most, and it sets them up for a more stable, unified future.